According to expert statistics, global electric vehicle (EV) sales have surged from 2 million units in 2018 to over 10 million units in 2022, increasing market share from 2.5% to 14%. This robust growth in the global EV market has propelled the development of power batteries, with global EV battery installed capacity skyrocketing from 59 GWh in 2017 to 518 GWh in 2022, boasting a staggering compound annual growth rate (CAGR) of 54%.

As the global trend towards electrification continues, BloombergNEF predicts that global EV sales are expected to reach a new high of 13.6 million units in 2023. SNE Research also anticipates a surge in the global EV battery market, projecting an increase from 518 GWh in 2022 to approximately 749 GWh in 2023, setting a new historical record.

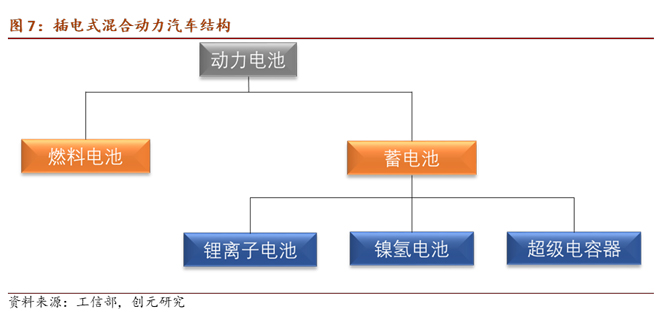

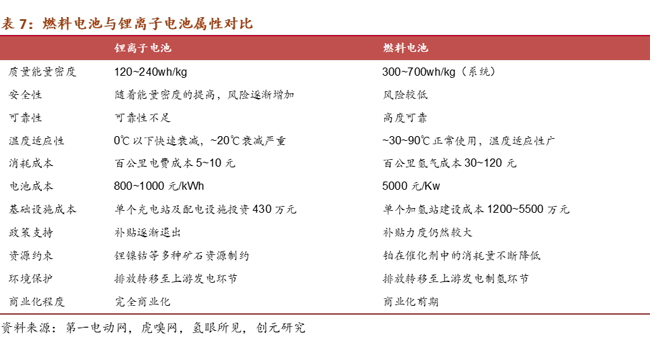

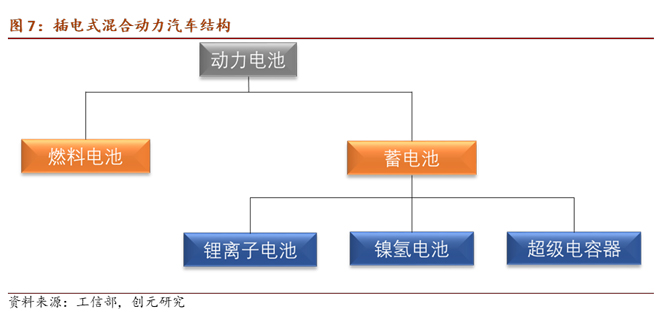

According to the battery structure and operating principles, power batteries can be classified into rechargeable batteries and fuel cells.

Power Battery

Power storage batteries include lithium-ion power storage batteries, metal hydride nickel power storage batteries, and supercapacitors, excluding lead-acid batteries.

Due to technological advancements and cost considerations, lead-acid batteries have been phased out in automotive power batteries. Currently, mainstream automotive manufacturers primarily use lithium-ion batteries, with a few opting for nickel-metal hydride batteries, such as Toyota.

Advantages of Lithium-ion Batteries

High Energy Density

Lithium-ion batteries weigh only half as much as nickel-metal hydride and nickel-cadmium batteries with the same capacity. The volume of lithium-ion batteries with the same capacity is 40%-50% smaller than nickel-cadmium batteries and 20%-30% smaller than nickel-metal hydride batteries.

Non-polluting

They do not contain substances like lead and cadmium that cause environmental pollution.

No Memory Effect

No need to discharge before charging.

Long Lifespan

Cycle life exceeds 500 cycles.

High Voltage

The voltage of a single lithium-ion battery is 3.6V, equivalent to a series connection of three nickel-cadmium or nickel-metal hydride batteries.

Low Self-discharge

The self-discharge rate of fully charged lithium-ion batteries stored at room temperature is around 10% after one month, much lower than 25-30% for Ni-Cd and 30-35% for Ni-MH. It is the preferred on-board battery for research institutions and automotive manufacturers after nickel-metal hydride batteries.

Disadvantages of Lithium-ion Batteries

Poor safety and high cost.

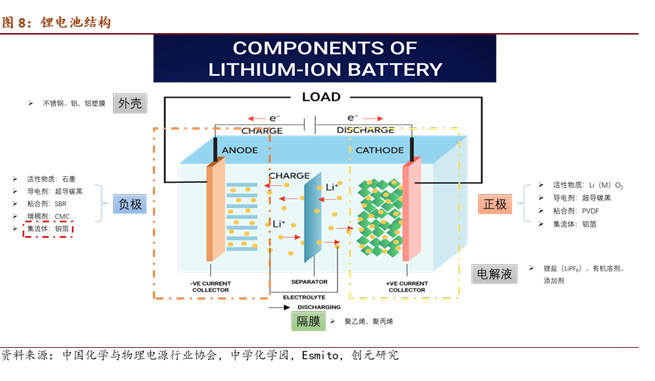

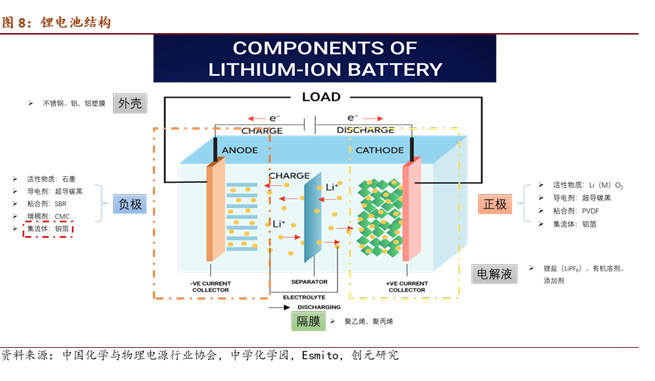

Composition of Lithium-ion Batteries: Positive electrode + Separator + Negative electrode + Electrolyte + Casing

Positive Electrode: Active material (Li(Me)O2) + Conductive agent (superconductive carbon black) + Binder (PVDF) + Current collector

Negative Electrode: Active material (graphite, Si, Sn alloy) + Conductive agent (superconductive carbon black) + Thickening agent (CMC: carboxymethyl cellulose) + Binder (SBR: styrene-butadiene rubber latex) + Current collector

The separator is a microporous film with a certain porosity and electron insulation, used to separate the positive and negative electrodes of the battery, preventing short circuits caused by contact between the positive and negative electrodes. Common materials include polyethylene and polypropylene.

The electrolyte is generally composed of non-aqueous organic solvents, lithium salts, and some additives. It establishes a good ionic conduction channel between the positive and negative electrodes inside the battery. The commonly used organic solvent is ethylene carbonate, and the main lithium salt is LiPF6.

Additives can be classified by function into flame retardant additives, film-forming additives, etc. Common materials include trimethyl phosphate, ethylene carbonate, etc.

The casing is mainly composed of materials such as aluminum, aluminum-plastic film, and stainless steel.

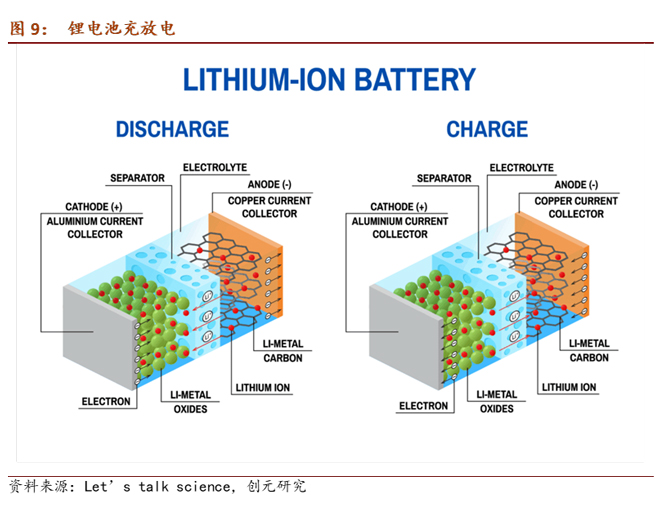

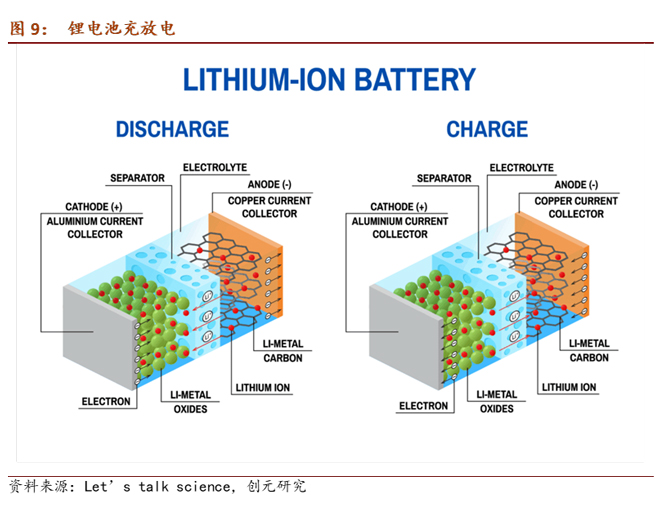

During lithium-ion charging, lithium metal oxide Li(Me)O2 in the cathode loses lithium ions and an equal amount of electrons, while the anode gains electrons and lithium ions to form lithium atoms. During discharge, lithium atoms at the anode decompose into lithium ions and electrons, which then return to the cathode. In actuality, due to the nearly light-speed conduction of electrons, when electrons reach the electrode, lithium ions in the electrolyte cannot instantly catch up. Instead, lithium ions originally present in the electrolyte follow the path of electrons to reach the electrode. Since the electrolyte contains lithium salt and must maintain electrical neutrality, when one lithium ion enters the electrolyte, another lithium ion leaves.

The current collector is the carrier of the positive and negative electrode materials, collecting the current generated by the electrode active material and outputting it.

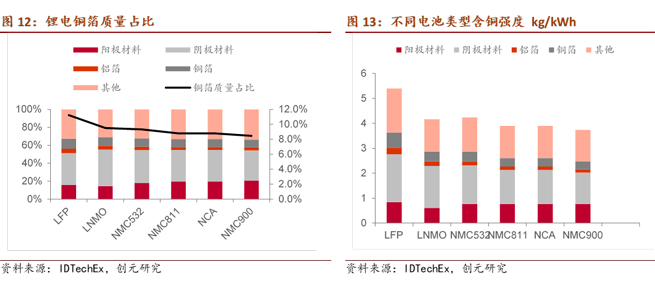

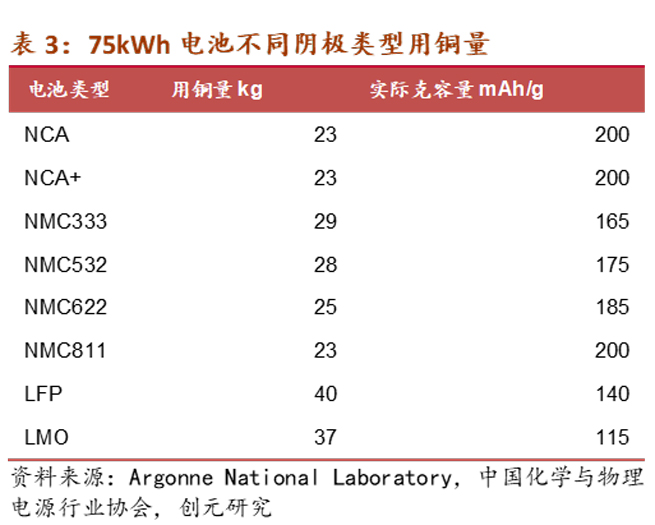

Characteristics of the current collector include high conductivity, chemical and electrochemical stability, high mechanical strength, good compatibility and adhesion with the electrode active material, and cost-effectiveness. Metals are commonly used as current collector materials. Copper and aluminum are widely used, with copper typically used as the current collector for negative electrode active materials (Anode) such as graphite, silicon, tin, cobalt-tin alloy, etc. Common types include copper foil current collectors, foam copper current collectors, and three-dimensional copper nanowire current collectors.

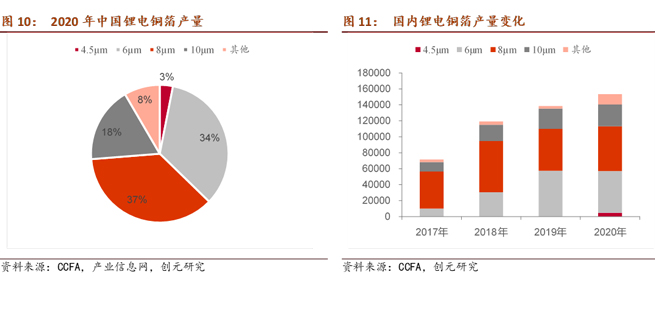

As the market increasingly seeks higher energy density and lower costs, the trend toward lightweight and thin copper foil is evident. From a technical perspective, thinner lithium copper foil results in lower resistance, simultaneously reducing the weight of the corresponding battery, thereby improving energy density and reducing costs.

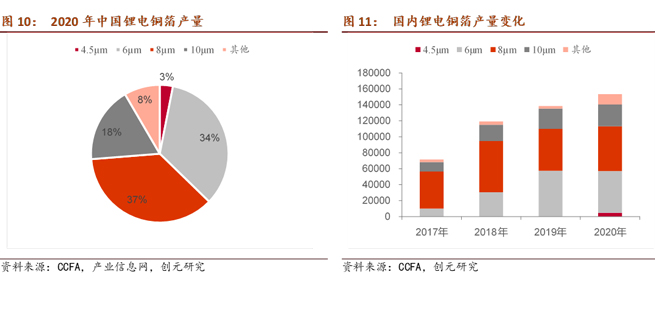

Looking at the production of lithium copper foil in recent years, the proportion of 6μm and below has gradually increased. In 2020, it accounted for 37% of the total production of lithium copper foil. In recent years, companies have been actively pursuing lightweight copper foil. From the perspective of technology, as the thickness of lithium copper foil decreases, the resistance decreases, and the weight of the corresponding battery is reduced, thereby increasing energy density and reducing costs.

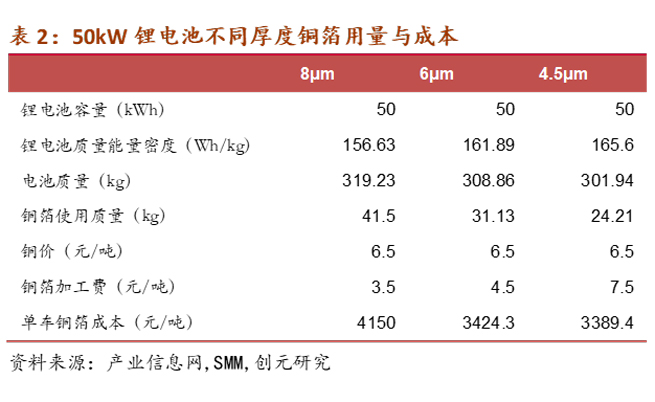

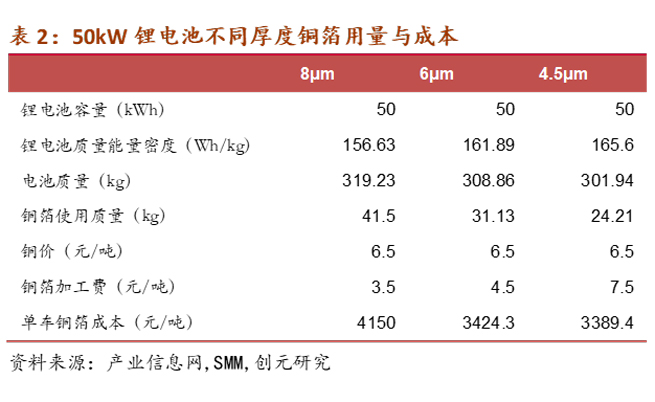

Based on the data from an industry information website, for a 50kWh lithium-ion battery, the energy density of lithium batteries corresponding to 8μm, 6μm, and 4.5μm is 156.63 Wh/kg, 161.89 Wh/kg, and 165.6 Wh/kg, respectively. The corresponding copper foil usage is 41.5kg, 31.13kg, and 24.21kg. It can be seen that the usage (compared to 8μm) has decreased by 25% and 42%. Calculating based on a copper price of 65,000 yuan/ton and copper foil processing fees of 35,000 yuan/ton, 45,000 yuan/ton, and 75,000 yuan/ton, the copper foil costs for each new energy vehicle are 4150 yuan/ton, 3424.3 yuan/ton, and 3389.4 yuan/ton, respectively. The cost reductions (compared to 8μm) are 17.5% and 18.3%.

Jin Tian Copper Strip Co., Ltd. is the production and operation entity of Ningbo Jin Tian Copper (Group) Co., Ltd. It was established in 2005 and has production workshops covering approximately 120,000 square meters, with fixed assets exceeding 1 billion yuan. After more than ten years of development and accumulation, the company has become an advanced domestic processing and manufacturing base for copper strip materials, focusing on the research and development and production of various high-precision copper strip materials. It ranks fifth among Chinese copper strip material enterprises. The company's products include various high-precision tin-phosphor bronze strips, red copper strips, brass strips, lead frame copper strips, copper-nick.

Fuel Cells

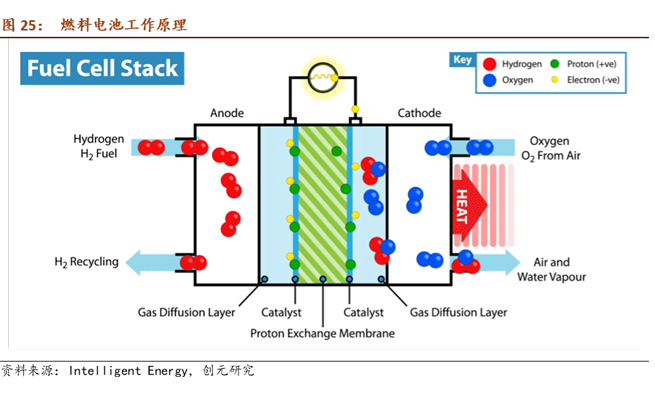

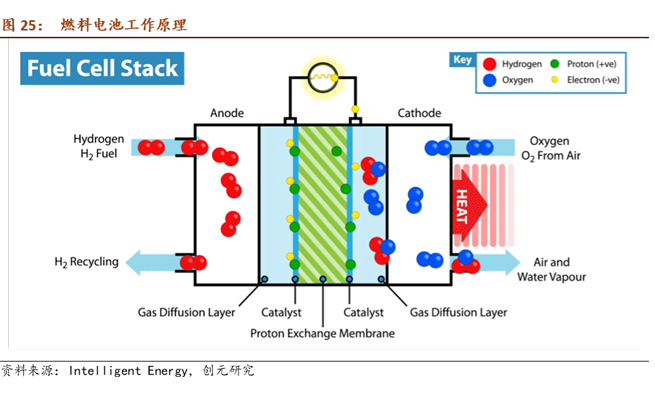

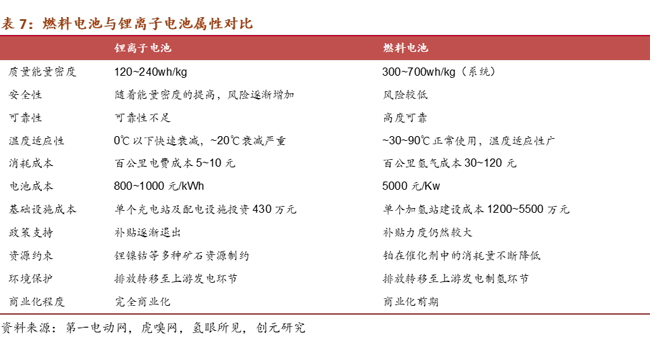

Fuel cells are a clean, efficient, reliable, and quiet source of energy. They convert the chemical energy of hydrogen and oxygen fuel into electrical energy through electrochemical reactions. Unlike traditional internal combustion engines, the only byproduct of the reaction is water, produced simultaneously with electricity and heat. In theory, fuel cells are not batteries; they are a type of engine. Batteries store energy, while fuel cells convert chemical energy into electricity through the "burning" of hydrogen, making them energy conversion devices akin to traditional internal combustion engines.

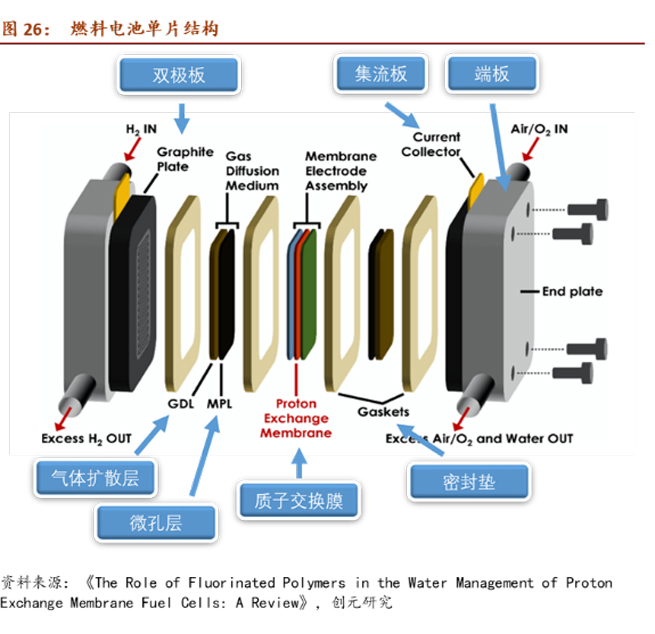

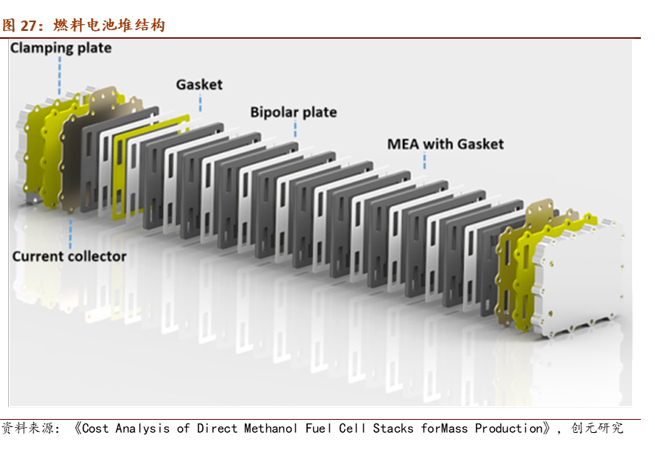

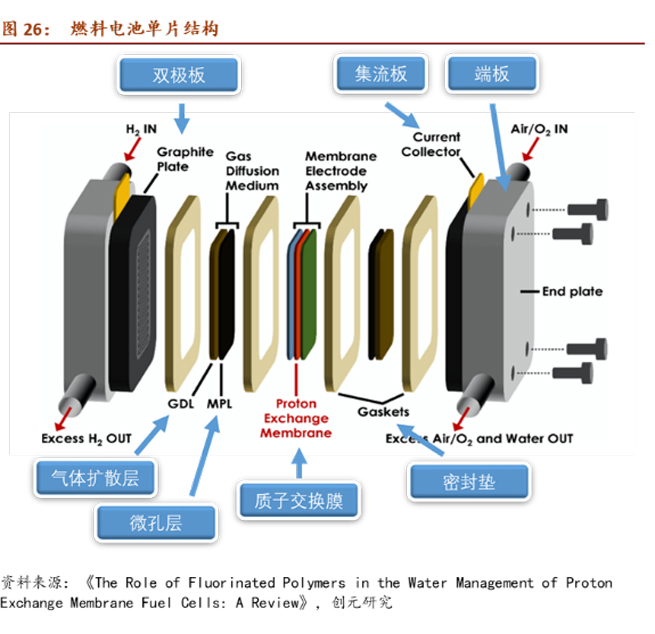

The working principle of fuel cells involves the decomposition of hydrogen molecules into protons and electrons at the anode. Protons move through the proton exchange membrane to reach the cathode, while electrons are forced to pass through the circuit, generating current and excess heat. Subsequently, at the cathode, they react with oxygen atoms to produce water. Typically, each cell generates 0.6-0.7V. By connecting multiple cells in series, a fuel cell stack with the desired voltage can be produced. (The Toyota Mirai (2022 model) fuel cell stack incorporates 330 cell plates.)

Advantages of Fuel Cells

Disadvantages

High cost, several times or even tens of times that of lithium-ion batteries, from production for each vehicle's battery capacity requirements to infrastructure construction.

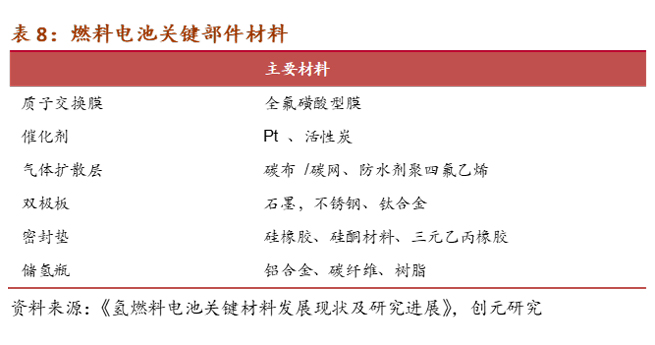

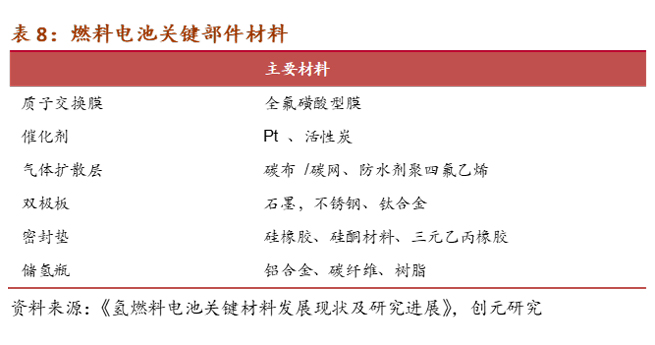

Composition of Fuel Cells: Proton exchange membrane + Catalyst + Gas diffusion layer + Bipolar plate.

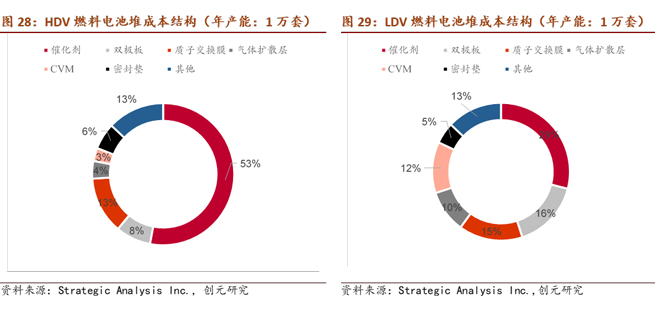

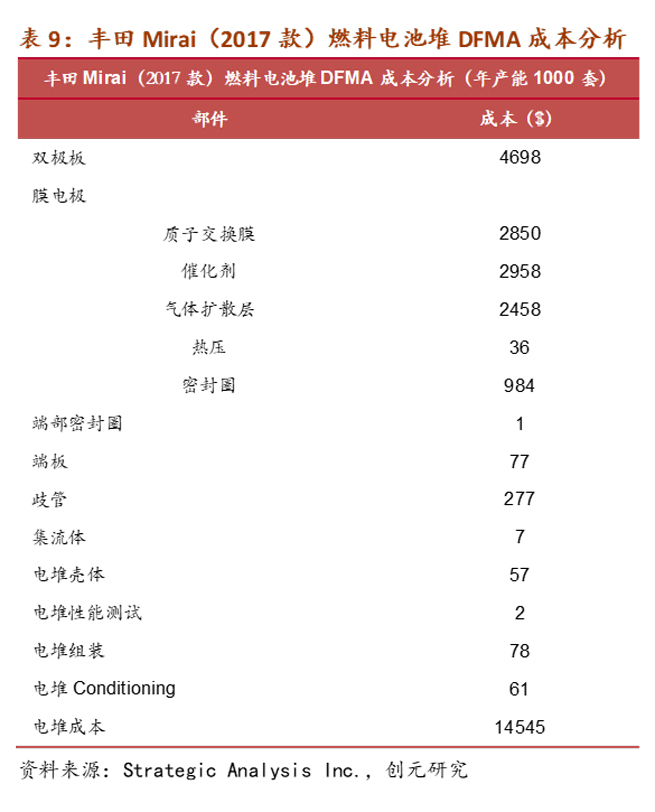

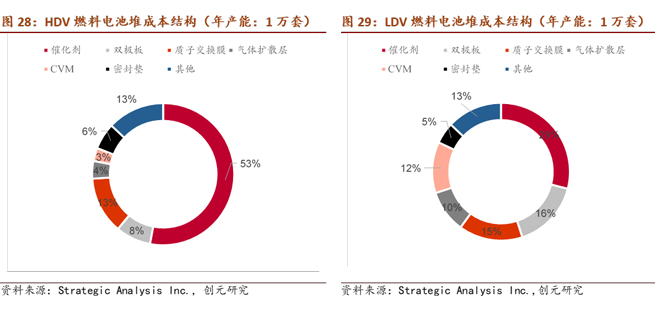

The catalyst consists of nanoscale Pt particles and high surface area active carbon. Due to the presence of the precious metal Pt, the catalyst's cost in a fuel cell is the highest, accounting for around 50% of the production line's cost for an annual capacity of 10,000 sets. According to Academician Yi Baolian of the Chinese Academy of Engineering, the international usage of Pt in fuel cells is 0.2g/kW, while in China, it has reached 0.4g/kW. Considering a fuel cell power of 120 kW per vehicle, the cost of metal Pt alone is approximately ¥7,000 per vehicle.

The proton exchange membrane's main function is to force electrons to travel through the external circuit to reach the cathode, prevent the passage of hydrogen molecules, water molecules, etc., and transport hydrogen ions (protons) to the cathode to react with electrons, forming a circuit. The proton exchange membrane needs to have high proton exchange rate, low electron conductivity, gas permeability, good chemical stability, and thermal stability. Currently, the mainstream material is perfluorosulfonic acid-type membrane.

The gas diffusion layer mainly provides a transmission channel for the participating gases and generated water, and supports the catalyst. It is usually composed of carbon cloth/carbon felt and a waterproofing agent polytetrafluoroethylene, with a cost accounting for about 4% of the fuel cell stack.

Bipolar plates, due to their good conductivity, suitable hydrophilicity, hydrophobicity, gas impermeability, and corrosion resistance, play several roles in a fuel cell:

Transport and distribute fuel.

Isolate hydrogen and oxygen.

Connect two adjacent single cells.

Graphite bipolar plates are mainly made of graphite, while metal bipolar plates typically use titanium alloy or stainless steel. Composite bipolar plates can be divided into non-metallic and metallic bases. Non-metallic bases mainly use materials such as resin and carbon fiber, while metallic bases use alloy plates as separators and carbon-based materials as flow fields, combining the advantages of metal plates and carbon-based plates.

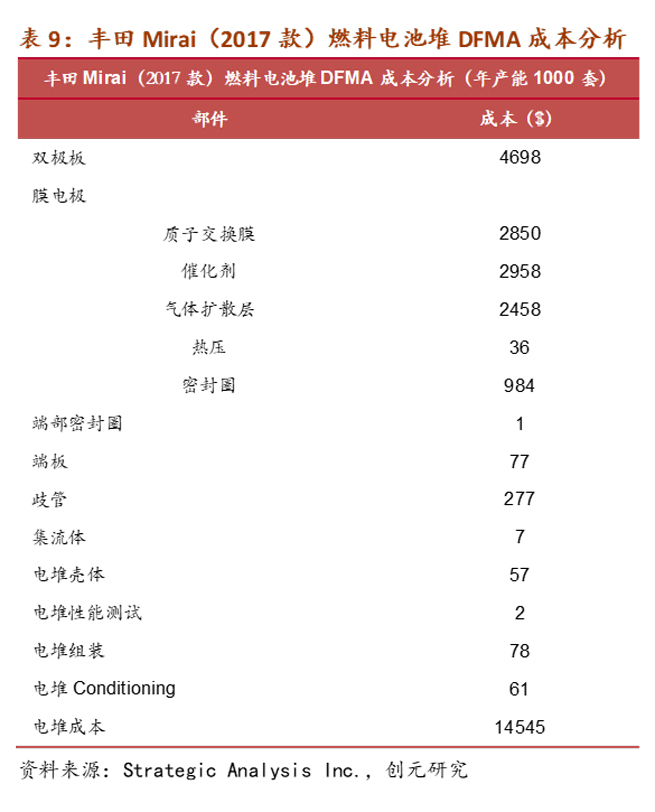

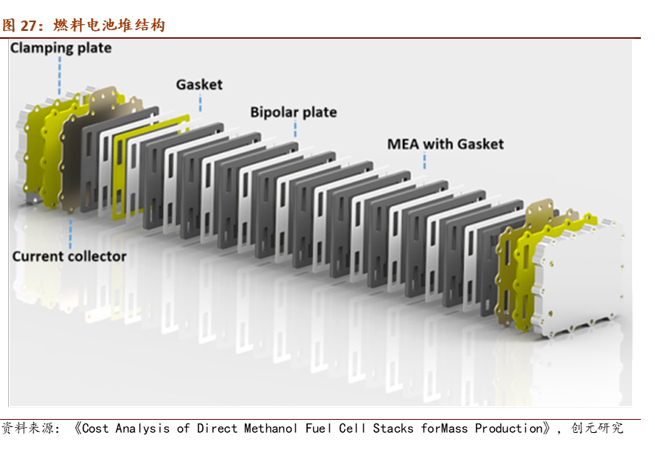

Fuel cell stacks are formed by stacking fuel cell units in a cascading manner, with bipolar plates and membrane electrode assemblies (proton exchange membrane, catalyst, gas diffusion layer) alternatingly stacked and embedded in seals. Flow plates and insulation plates are placed at both ends and tightened with bolts. Structurally and in terms of materials, the most likely use of copper in fuel cells is in the collector, where commonly used materials include copper, nickel, and gold-plated metal plates. Based on the Design for Manufacture and Assembly (DFMA) cost estimation for the Toyota Mirai (2017 model) fuel cell stack conducted by Strategic Analysis Inc. in 2018, the collector cost is $7. According to the LME copper average price of $6,500 per ton that year, the estimated copper usage is 1.08 kg. With the Mirai (2017 model) fuel cell power at 114 kW, from the assembly structure of the fuel cell stack, increasing power only requires stacking additional single cells. When power changes are not significant, it can be assumed that the effect of copper usage on the collector is minimal.

The power system of a fuel cell vehicle is primarily composed of a fuel cell stack, a boost converter, a power battery, a high-pressure hydrogen tank, an electric motor, a power control unit, and auxiliary components. The boost converter increases the voltage from less than 300V to 650V. This is necessary because the single-cell voltage of a fuel cell is relatively low. By introducing a boost converter, the number of fuel cell stack layers can be reduced, controlling the volume and weight of the fuel cell stack. The power battery is typically a lithium-ion battery with a relatively small capacity, usually ranging between 1 to 2 kWh. The power battery serves two purposes: firstly, it can recover energy during braking and deceleration, and secondly, it collaborates with the fuel cell to drive the electric motor when high power output is required. The hydrogen storage tank, similar to a traditional fuel tank, stores hydrogen as fuel. It usually operates at a pressure of around 70 MPa and can store approximately 5 to 6 kg of hydrogen. The energy density of hydrogen is 33.6 kWh/kg, which is more than 10 times higher than lithium-ion battery materials. As a fuel cell operates as an open system, its energy density essentially depends on the stored hydrogen quantity. In the future, with continuous advancements in hydrogen storage technology, fuel cells have significant potential for increased energy density compared to lithium-ion batteries.

Currently, the commercial application of fuel cell passenger vehicles in the global market is still in its early stages. Mainstream models include the Toyota Mirai, Hyundai Nexo, and Honda Clarity Fuel Cell (Honda announced the suspension of production on June 15, 2021). Additionally, Mercedes-Benz offers the GLC f-Cell for lease to specific users only. In 2021, the global sales of fuel cell vehicles in major countries reached 16,313 units, showing a 68% increase compared to 2020. South Korea dominated these sales with 8,498 units, constituting 52% of the total. Looking at the global distribution of fuel cell vehicle ownership, it is primarily composed of passenger vehicles, accounting for 82% of all Fuel Cell Electric Vehicles (FCEVs) worldwide. In contrast, China has a different structure, with a focus on commercial vehicles. According to statistics from the China Association of Automobile Manufacturers, in 2021, China's sales of fuel cell vehicles were 1,556 units, with commercial vehicles accounting for 99.4%.

Jintian Copper is a leading domestic supplier of copper materials in the new energy vehicle industry, producing copper rods, copper strips, copper bars, copper wires, electromagnetic wires, magnetic steel, and other products. We offer a one-stop procurement service for our customers. Feel free to contact us at 0574-83005999.

English

English 日本語

日本語 한국어

한국어 français

français Deutsch

Deutsch Español

Español italiano

italiano العربية

العربية tiếng việt

tiếng việt Türkçe

Türkçe ไทย

ไทย 中文

中文