The swift expansion of the electric vehicle (EV) industry in China has led to an increasing demand for charging stations. According to data compiled by the China Charging Alliance, as of December 2022, the cumulative number of charging infrastructure nationwide reached 5.21 million units, marking a remarkable 99.1% year-on-year increase compared to the 2.617 million units reported in the same period of 2021. Charging stations for new energy vehicles are generally categorized into public and private, with public charging stations accounting for 1.797 million units, an increase of 651,000 units from 2021 and a year-on-year growth of 56.7%. On the other hand, privately owned charging stations associated with vehicles saw a significant rise to 3.412 million units, up by 1.942 million units from 2021, reflecting a notable 132.1% year-on-year increase.

The development of charging facilities is more rapid in the eastern and southern regions, as well as in first and second-tier cities. Projections indicate that by the end of 2026, the market size of the charging station industry in China is expected to reach ¥287 billion, with a five-year compound annual growth rate (CAGR) reaching 37.8%. This surge in market size reflects the accelerating pace of electric vehicle adoption and the corresponding demand for charging infrastructure in the country.

The rapid development of charging stations is inseparable from robust government support. Eight departments, including the Ministry of Industry and Information Technology (MIIT), have organized pilot projects in comprehensive electrification of public sector vehicles, ensuring a well-supported system for charging and battery swapping services. The goal is to establish a forward-looking, balanced, and intelligent charging and swapping infrastructure system, significantly enhancing service capabilities. The aim is to achieve a 1:1 ratio between newly added public charging stations (standard stations) and the promotion of new energy vehicles in the public sector (standard vehicles). Additionally, it is anticipated that the proportion of charging facilities in service areas along highways will not be less than 10% of small parking spaces. This initiative aims to create a set of exemplary comprehensive energy service demonstration stations.

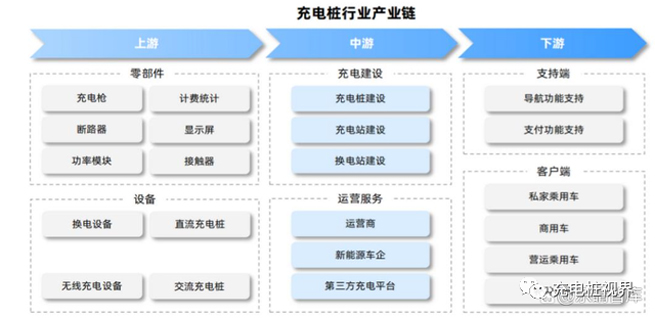

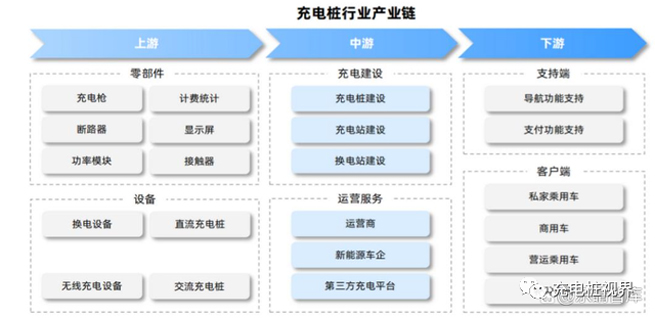

Charging Station Industry Chain

The upstream of the charging station industry chain involves the manufacturing of equipment components, the midstream encompasses the manufacturing and operation of charging stations, while the downstream includes vehicle manufacturers and charging solution providers.

Upstream: Charging Equipment Components

Charging Modules, Power Devices; Contactors, Transformers; Connectors, and Battery Maintenance Equipment, etc.

Charging modules, constituting 50% of the total cost and including key manufacturers such as Greenergy Smart Charging, Shenghong, and Kstar.

Major connecting products, such as contactors, relays, and connectors, involve prominent manufacturers like Qunying, Yonggui Electric, and Zhonghang Optoelectronic. In the circuit breaker segment, representative companies include Liangxin Electric and Beiyuan Electric.

Leading manufacturers in distribution equipment include Huarui Yineng, Siemens, Xujidianqi, Hengkai Electric, and Weiteng.

Active filtering equipment involves key players like KELU Electronics, Shenghong, and Siyuan Electric. In the billing and monitoring equipment category, manufacturers include Xujidianqi, Juhua Technology, and Yingkerui.

Management equipment, including LED displays and management auxiliary devices, features notable participants like Zhouming Technology, Emerson, and Siyuan Electric.

Midstream: Charging Station Equipment Manufacturing and Operation

The midstream of the charging station industry primarily includes integrated manufacturing (charging and distribution equipment), represented by companies like Bull Group, Vorx Nuclear Materials, and Shenghong.

There is a business overlap between integrated manufacturing and operation in the charging station industry. Many mainstream charging station companies adopt an "production + operation" integrated model. Operating companies include power grid enterprises and charging station manufacturers.

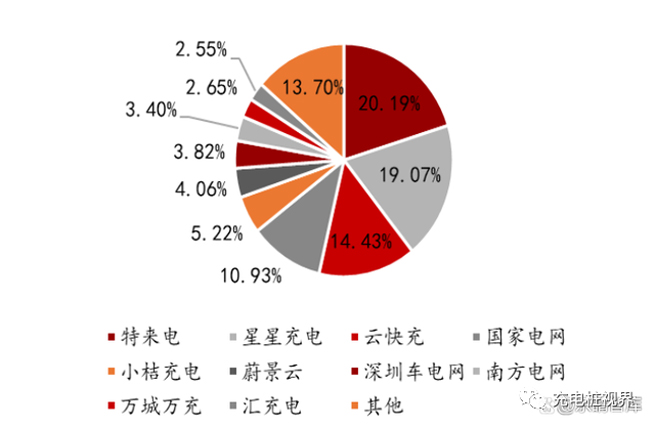

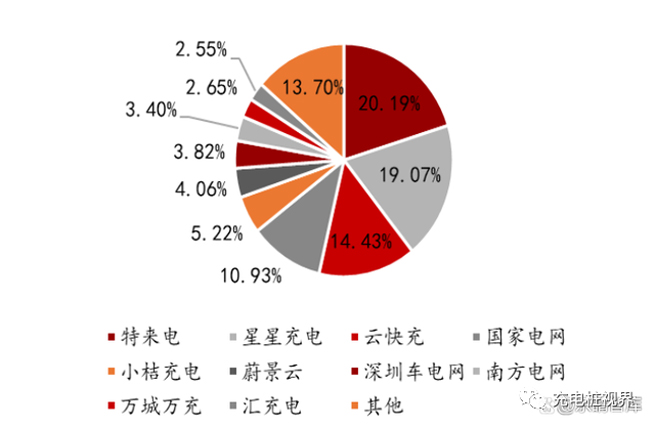

The effect of industry concentration among operators of public charging facilities is gradually becoming prominent. As of December 2022, among operators of public charging stations, leading enterprises still have a high market share in specific segments of public charging infrastructure. The market share of the top 5 operators reaches 69.8%, and the share of the top 10 reaches 86.3%. It is expected that the market share of leading companies among public charging facility operators will further expand in 2023.

Market Share of Top 10 Operators:

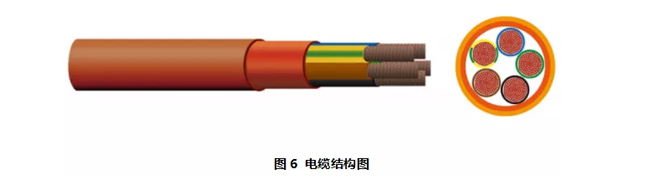

Electric Vehicle Charging Cables

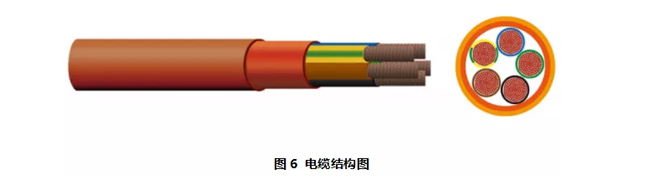

Electric vehicle charging cables are used to connect electric vehicle charging equipment with charging infrastructure, enabling the transmission of power to electric vehicles. These cables are equipped with a specific number of signal lines, control lines, power auxiliary lines, etc., to ensure precise control and safe operation throughout the charging process. Charging cables are commonly employed in areas such as charging stations, parking lots, hotels, residential communities, garages, etc. Portable charging cables can be stored inside the vehicle for convenience.

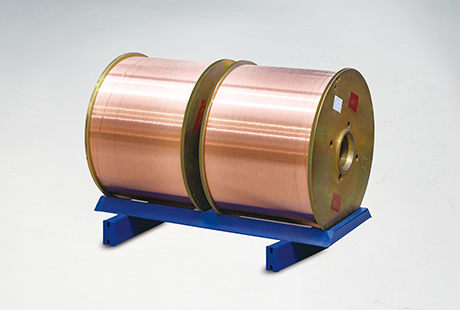

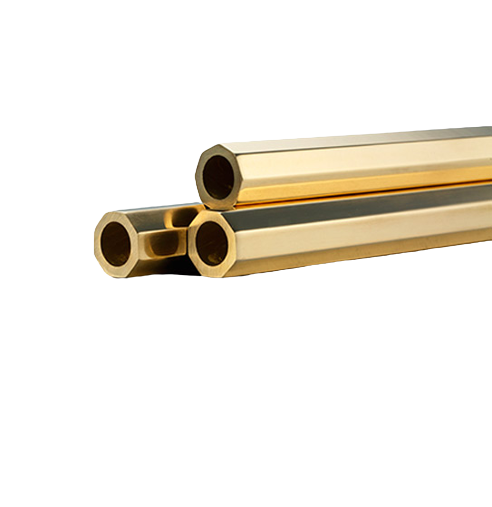

The image above shows a copper wire used in the cable. Upon observation, it is evident that the primary material for the internal conductor is copper. Taking into account other components of the charging station, calculations reveal that a DC charging station consumes approximately 70 kg of copper, while an AC charging station consumes about 4 kg of copper.

Jintian Copper, specializes in the production of copper wires, copper bars, magnetic steel, copper strips, copper rods, copper tubes, fittings, and other copper products. The company holds IATF16949 certification. Feel free to contact us for inquiries at 0574-83005999.

English

English 日本語

日本語 한국어

한국어 français

français Deutsch

Deutsch Español

Español italiano

italiano العربية

العربية tiếng việt

tiếng việt Türkçe

Türkçe ไทย

ไทย 中文

中文